High Risk Merchant Account Highriskpay.com | Full Guide 2023

Navigating High Risk Merchant Accounts with highriskpay.com and netpaybankcard.com

High Risk Merchant AccountHigh-riskpay.com

Fear not, for in this article, we’ll navigate through the concept of high risk merchant accounts and shed light on how highriskpay.com and netpaybankcard.com can help secure your online transactions. So, fasten your seatbelts as we embark on this informative journey!

Understanding High Risk Merchant Account

In the vast ocean of e-commerce, not all businesses sail in the same waters. Some ventures, due to their nature, are deemed “high risk.” But what exactly does that mean? A high risk merchant account is like a specialized lifeboat for these businesses, offering them a safe haven to process transactions without capsizing. It’s a tailored solution that provides additional security measures to safeguard both the business and its customers.

High Risk Merchant Account | About HighRiskPay.com

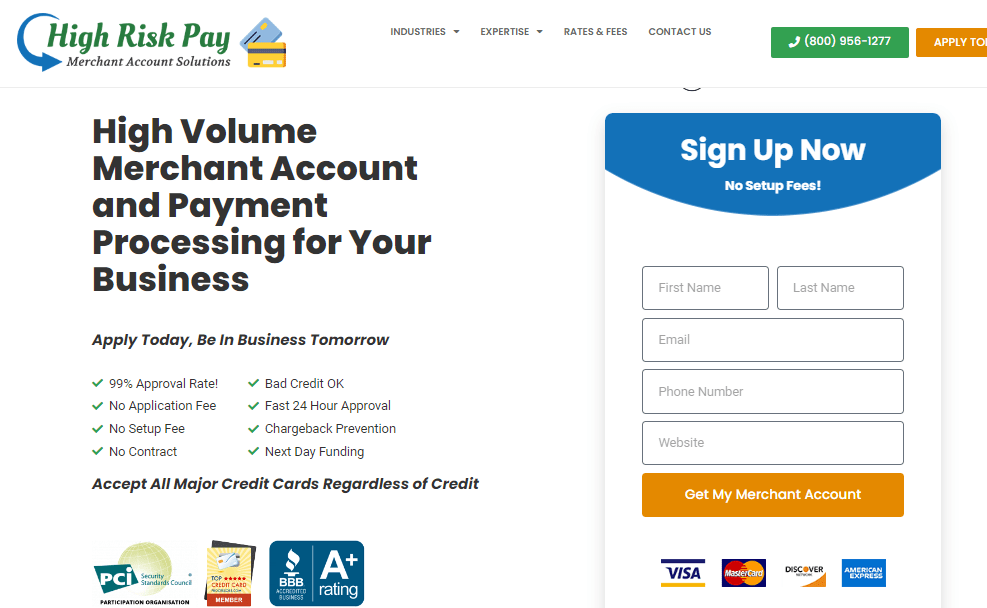

Welcome to High Risk Pay, a powerhouse in the credit card industry that’s been rapidly growing since 1997. Our mission? Simple – to make our customers thrilled and to stand as a rock-solid provider.

Picture this: a sprawling nationwide network that connects seamlessly with our processing banks, reaching out to merchant accounts with an efficient credit card processing service. And here’s the kicker – our rates are super affordable, giving our customers the tools to keep their businesses running smoothly. Need help? Our customer service is live and ready 24/7 to assist you!

Ready for a game-changer? Get in touch with us today and discover how embracing credit cards with High Risk Pay can revolutionize your business. Apply now for a credit card merchant account using our free online application – no application fee, no setup fee. What’s even cooler? You’ll be set up to accept major credit cards for your sales within just 24-48 hours, regardless of your credit history. Once you complete the online application and get the green light, you’re good to go!

At High Risk Pay, we’re all about making waves in the credit card world and transforming your business journey.

High-Risk Merchant Services For Any Credit History

Hey there, risk-taker! Listen up – if bad credit’s been giving you the blues, worry not. We’ve got your back with a high-risk merchant account that’s ready to roll, no matter the credit score. And here’s the kicker – we’re not just talking the talk. Our high-risk merchant account boasts an eye-popping 99% average approval rate – the cream of the crop in this industry. Yep, you read that right!

At High Risk Pay, we’re all about making things swift and smooth. Say goodbye to those pesky setup and cancellation fees – we’re waving them off. You want fast approvals? You got it. Applying online is a breeze, no hassle involved. So, what are you waiting for? Dive into the world of bad credit merchant accounts with us, and let’s get your business soaring!

The Role of highriskpay.com

Enter highriskpay.com, your trusted co-captain in the high-risk e-commerce voyage. Picture this: just as a lighthouse guides ships through treacherous waters, highriskpay.com guides high-risk businesses through the intricate payment processing landscape. With their expertise, they offer seamless and secure payment solutions, allowing you to focus on steering your business towards success.

Exploring High Risk Merchant Accounts

High risk doesn’t equate to impossibility. In fact, numerous businesses flourish under this banner. Whether you’re in the adult entertainment industry or dealing with subscription services, a high risk merchant account empowers you to embrace online transactions confidently. It’s a virtual life vest that ensures your business stays afloat, no matter the waves.

The Safety Net: netpaybankcard.com

Speaking of staying afloat, netpaybankcard.com is another key player in the high-risk e-commerce realm. Think of them as the safety net beneath the trapeze artist – always ready to catch you. They specialize in mitigating the risks associated with high-risk transactions, allowing your business to process payments securely and efficiently.

Is Your Business a Good Fit?

Not every ship is destined for high risk waters. Before you dive in, it’s crucial to determine if your business is a good fit for a high risk merchant account. Are chargebacks a common occurrence in your industry? Does your business operate in a sector with regulatory complexities? If the answer is yes, then a high-risk account might just be the anchor you need.

Why High Risk? Unpacking the Factors

Why are certain businesses labeled “high risk” in the first place? It’s like being in a game of chess – multiple factors come into play. From industry reputation to payment processing history, each move matters. Understanding these factors can help you strategize effectively and make informed decisions for your business’s financial future.

Mitigating Risk: Tips for a Secure Merchant Account

Now that you’ve set sail on the high-risk seas, how can you ensure a safe voyage? Consider these tips:

- Robust Data Security: Invest in top-notch data security measures to protect sensitive customer information.

- Chargeback Prevention: Implement strategies to minimize chargebacks, like clear refund policies and responsive customer service.

- Regulatory Compliance: Stay updated with industry regulations to ensure your business operates within legal boundaries.

The Application Process: Simplified

You might be wondering about the process of obtaining a high risk merchant account. Think of it as applying for a passport before an overseas adventure. The application process involves providing necessary documents, understanding the terms, and partnering with a reliable provider like highriskpay.com or netpaybankcard.com.

Common Myths Debunked

Myth 1: High risk means guaranteed failure. Reality: Many successful businesses thrive in high risk sectors.

Myth 2: High risk merchant accounts attract fraud. Reality: With proper security measures, risks can be significantly minimized.

What does due to high merchant risk mean?

In the realm of commerce, certain businesses earn the label “high-risk” due to their susceptibility to chargebacks, fraud, and other challenges. To process debit and credit card payments, these businesses require a specialized high-risk merchant account, acting as a protective shield against potential financial pitfalls.

Do I need a high-risk merchant account?

When a business presents an elevated risk of encountering fraud or chargebacks, or possesses particular defining attributes, it necessitates a high-risk merchant account for the acceptance of card payments. For instance, certain industries such as tobacco and firearm sales might face restrictions from specific processors due to their nature.

High Risk Merchant Account FAQs

Q1: What industries are often considered high risk?

A: Industries like online gaming, nutraceuticals, and travel services often fall into the high-risk category.

Q2: Will I pay higher fees for a high-risk account?

A: While fees might be slightly higher, the added security and potential for increased revenue often outweigh the costs.

Q3: How long does the application process take?

A: Typically, the process takes a few days to a couple of weeks, depending on the provider and your business’s readiness.

Q4: Can I switch from a standard account to a high-risk account?

A: Yes, you can, but it’s important to evaluate the reasons for the switch and work with a knowledgeable provider.

Q5: What happens if my chargeback ratio is high?

A: High chargeback ratios can lead to account freezes or even termination, underscoring the importance of proactive chargeback prevention.

Conclusion about High Risk Merchant Account Highriskpay.com

As you set sail on your high risk merchant account journey, remember that highriskpay.com and netpaybankcard.com are your trustworthy navigators through the stormy waters of high-risk e-commerce. With their expertise and your determination, your business can conquer the high seas and achieve prosperous horizons. Bon voyage!